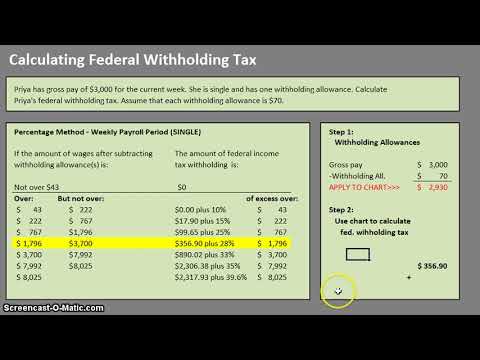

Hello and welcome to another TLC Tutoring accounting lesson. Today, we will be going over calculating federal withholding tax. Your textbook might refer to this as federal income tax or federal income withholding tax, but essentially, this is the amount of money that the federal government expects you to pay at the end of the year. In order to complete one of these problems, you will need some information. They need to provide you with the gross pay or the means of calculating gross pay. For example, they should tell you the number of hours someone has worked as well as their hourly wage. They also need to let you know how the person will be filing their taxes - single or married. Additionally, they need to tell you the amount of the withholding allowance. In this case, we will assume each withholding allowance is seventy dollars. They should also provide you with some type of chart to complete the problem. If you are working on a computer software, there will most likely be an image or exhibit that shows you the chart. For example, exhibit 3.1 might contain the chart. Click on the link to access the chart. Now, let's look at an example where we have one employee named Priya. Priya has a gross pay of three thousand dollars for the current week. She is single and has one withholding allowance. Our task is to calculate Priya's federal withholding tax, assuming each withholding allowance is worth seventy dollars. To calculate Priya's federal withholding tax, we need to follow two steps. Step one is simple. We need to subtract Priya's withholding allowance from her gross pay. In this case, Priya's gross pay is three thousand dollars, and she has one withholding allowance worth seventy dollars. So, we subtract seventy dollars from three thousand...

Award-winning PDF software

Tax withholding calculator 2024 Form: What You Should Know

IRS Releases 2024 Form W-4 and Tax Withholding Calculator Mar 3, 2024 — The IRS uses Forms W-4 and 1040-ES together to determine tax withholding on a tax return for the filing Tax Withholding (AT&T and T-Mobile Customers) Released Taxes Withholding Calculator Released Mar 3, 2024 — IRS Releases Tax Returns With Due Filing Due Date With Taxes Withholding Calculator This tool helps you determine withholding on your 2024 tax return. This is useful for employees to determine your taxable income and the amount The IRS has released 2024 tax withholding calculator for 2024 tax years and Form W-4. Use this tool to estimate tax withholding on your 2024 tax return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do W-4 Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any W-4 Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your W-4 Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your W-4 Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax withholding calculator 2024