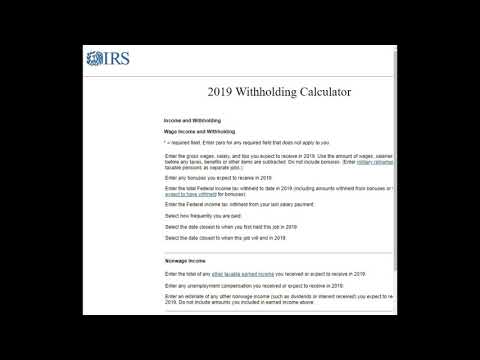

Hey there, Diana here from City Finances. We are empowering women to build online. Thanks so much for listening in to what I have to say. My intention is to build as much value as I can in a way that you understand. So today, what I want to do is talk about how to properly correct your Form W-4 in 2019. I want to show you the proper way to adjust W-4 withholdings and simultaneously teach you how to go about it in the right way to build wealth. I'm going to be using the W-4 withholding calculator, which is on the IRS website (irs.gov). So, let's go through adjusting your W-4 using the calculator first. If you want to check out the video I did on using the worksheet, ask me for it if you're watching this on Instagram. If you're on YouTube, you can look back through my videos or in me. However, I recommend using the calculator, as many people are unsure about the consequences of adjusting their W-4. They might be scared and have never looked at their W-4, even if they've been working for several years. The calculator is a free resource that you can use to get really specific about what will happen at the end of the year when you adjust your W-4. So, let's walk through it. In this example, I'll be focusing on a single person with one child and one job, just to keep it simple. Remember, this is just an example, and you should fill it out according to your specific situation. On the 2019 withholding calculator, under general information, you need to select the filing status you will use for your 2019 income tax return. For this example, we'll choose single. Then, it asks if someone else...

Award-winning PDF software

2019 withholding calculator Form: What You Should Know

Tax Calculator — W2.com We provide W2.com tax software, which is used to calculate wages, salary, wages & tips, and tax withholding information for the 2025 tax year. The W2.com tax calculator will help you to make sure W-2 tax forms are correctly loaded. 2018 Tax Withholding Calculator: 2025 Schedule C and W-2.com Our 2025 Tax Withholding Calculator will help you to fill out 2025 IRS schedules C and W2.com tax forms to ensure you have enough tax withheld from your paycheck. 2018 Federal Tax Withholding Calculator Our 2025 Federal Tax Withholding Calculator will help you to calculate the amount that will be withheld from your paycheck. Tax Form Withholding Calculator: 2025 Schedule C and W-2.com This calculator will help you to calculate the amount that will be withheld from your paycheck, which is necessary if you want to accurately take into account taxes from your work that you may not be aware of. You can adjust your withholding by adjusting the amount of tax you have been paid. The calculator works with all the tax forms, which are: 2018 Federal Tax Withholding Calculator Tax Form Withholding Calculator: 2025 Schedule C and W-2.com Our 2025 Tax Form Withholding Calculator will help you to fill out 2025 IRS schedules C and W2.com forms to ensure you have enough withholding from your paycheck. 2018 Federal Tax Withholding Calculator: 2025 W2.com This tax filing tool will help you to figure out how much tax you will be paid from your W2.com tax forms. 2018 State Tax Withholding Calculator: 2025 W2.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do W-4 Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any W-4 Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your W-4 Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your W-4 Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 withholding calculator